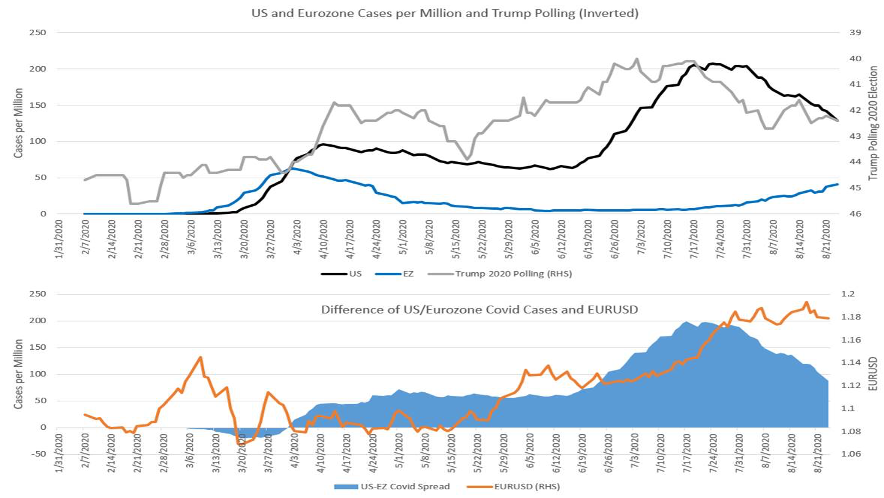

This 2-panel chart shows the relationship of (1) the number of US Covid cases (per million) with President Trump’s 2020 election polling and (2) the “spread” (US Covid cases minus European Covid cases) with the EUR/USD exchange rate.

Source: DoubleLine

The dollar weakened as new cases from the coronavirus outbreak surged throughout America from June onwards. President Trump’s handling of the pandemic was also criticized which hurt his reelection chances. However, there is marked improvement on both measures in the past one month, noted Sam Garza, macro PM at DoubleLine in Los Angeles.

Daily new cases have steadily fallen across much of the US, while cases in Europe are rising again and two thirds of countries have reimposed some restrictions. France recorded its biggest daily rise in coronavirus infections since March. Cases in Germany doubled this month. The “spread” favors a lower euro in the near term.

The election will be decided by the trend of Covid cases and the economy. Both trends are supportive of Trump at the moment. Post-convention polls show Trump has almost halved the national deficit against the Democratic nominee Joe Biden. He is making a comeback in swing states.

The corollary is the dollar could find support here and rally on a 3 to 5-month time frame. The 92-level is key on the dollar index.

On a longer horizon, Garza agreed with the rest of the group that the dollar outlook was challenged. “When the US got medical supplies shipped in during the height of the pandemic from China and Russia,” he mused, “that sort of felt like a poignant moment for what may be the reversing of American exceptionalism.”

A participant chimed in, “I’m wondering whether America is gradually turning into an emerging market.” Politically there is demagoguery, long-standing institutions are being threatened, there is political interference in deal making, and fiscal deficits are out of control. “If the EM template holds, it will get priced through the currency with a materially weaker dollar.”

Counterintuitively, stocks will do well as a nominal asset. We have seen this play out in Brazil and Argentina. Both currencies tanked but stocks rose to record highs. The idea being that it would be wrong to turn bearish on US stocks if American exceptionalism has indeed come to an end. “The S&P 500 index could zoom to 5,000,” he said.

Source: Slate