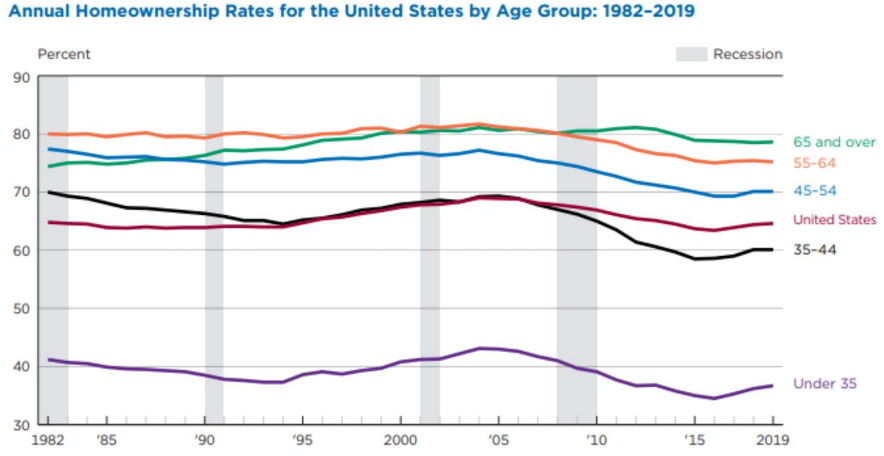

“This is the most important chart in housing,” said Cameron Khajavi, CIO of MIK Capital. It shows that the homeownership rate for those aged 35-44 and under 35 collapsed after the 2008 Great Recession and housing bust.

“Lower ownership was the result of a difficult job market, delayed family formation, higher levels of graduate studies enrollment, successful urban crime policies, and some cultural changes that made young people trade physical space for experiences,” said Khajavi. As shown in the chart, this trend bottomed and started reversing in 2017.

The displacement caused by the global pandemic should now lead to a home buying surge in America, built on Millennial demand. Khajavi noted, “Quarantine, the inability to travel, the ability to work from home (WFH) and low interest rates will renew interest in larger living space and single-family ownership.”

Source: NBER

The virus has pulled millions of people back into the homebuying market to look for a home for their families and remote work needs. With inadequate supply, a new construction boom is unfolding.

There are more than 40 million households in this demographic. If the homeownership rate rises 5 percent (to get midway to the 2006 bubble) or gains 10 percent (to all the way back to the peak), that’s 2 to 4 million extra homes to be occupied, renovated, and invested in. That’s a 35-75 percent increase compared to existing home supply.

“The market is too illiquid, and supply constrained to play this out in a year,” said Khajavi, “which is why it will take several years and require new construction to resolve itself.” This should benefit the homebuilders but also create a major tailwind for consumer spending. Home Depot, Lowe’s, Target, and William Sonoma all stand to benefit.

Source: Shutterstock