One of the best trades of the past decade was long Amazon and short retailers. The foresight was traditional retailers, with core physical stores and a limited online presence, are exposed to Amazon’s relentless online competition and pricing. The potential for a share shift was greater than ever before.

Amazon was worth around $50 billion in 2010. Five years later it surpassed Walmart as the world’s most valuable retailer at $250 billion. Today, it’s worth as much as 4 Walmarts and more than the ten largest public US retailers combined. This is popularly referred to as “Death by Amazon.”

Source: Visual Capitalist

As we look ahead, no sector is more primed for disruption than banks. We introduce a new multi-year theme: Death by Fintech.

The economic fallout from the coronavirus pandemic has hit banks hard. Net income across US banks plunged by 70 percent in the second quarter. Provisions for loan losses are at the highest in a decade as banks prepare for large-scale business bankruptcies. Borrowers are missing scheduled debt payments at a record pace, and banks are rapidly tightening credit in response.

The Fed estimates $700 billion in defaults as a worst-case scenario if the economy takes a long time to recover. A persistent period of depressed interest rates puts the squeeze on net interest margins, with further downward pressure on bank profitability over the medium term. Wells Fargo decided to cut its dividend by 80 percent.

A longtime advocate for the sector, Warren Buffett has significantly pared his holdings of bank stocks. The S&P 500 Financials sector index has fallen by 20 percent this year. The index is below its 2007 highs and trading at 2001 levels.

In contrast, fintech stocks are soaring. The pandemic has accelerated the adoption of digital financial services across all age groups and entire industries. The Global X FinTech ETF (ticker: FINX) has outperformed the technology sector by 30 percent since the March low and trounced the financials sector by 57 percent.

Square reported a 64 percent year-over-year jump in net revenue for the second quarter. Payment volume from online channels was up 50 percent, with online now making up more than a quarter of seller payment volume, up from 14 percent a year ago. “One in three new online sellers onboarded in the second quarter were entirely new to Square,” said CEO Jack Dorsey.

Square’s mobile payment service, Cash App, now has thirty million users and $1.7 billion in deposits. Six million new accounts were added in the first six months of the year.

An abrupt shift to online purchases sits behind the 119 percent year-over-year growth in gross merchandise volume that Shopify processed in the second quarter. Lending to merchants rose 65 percent, and the company announced a business debit card and an installment option for consumers. According to CEO Tobi Lütke, there is a growing conviction in “distributed entrepreneurship” over conventional employment. Shopify intends on to become a fintech behemoth for consumers and businesses alike.

PayPal added a record 21.3 million accounts in the second quarter, up 137 percent over the prior year. User transactions on its platforms were up 29 percent. The pandemic has made PayPal “more relevant” than ever before, CEO Dan Schulman told CNBC. “Across every industry, we’re seeing this surge towards a digital-first strategy.”

Square’s shares have surged 196 percent year-to-date, Shopify is up 172 percent, and PayPal has climbed 88 percent. PayPal’s market cap has surpassed that of Bank of America (the second biggest bank in the US), and Square is now more valuable than Goldman Sachs for the first time. The market discerns the future.

As fintechs reach critical mass, many have begun to embed more financial products to “rebundle” the bank. In March, Square received approval for a bank charter in a sign regulators are becoming more amenable to fintech companies.

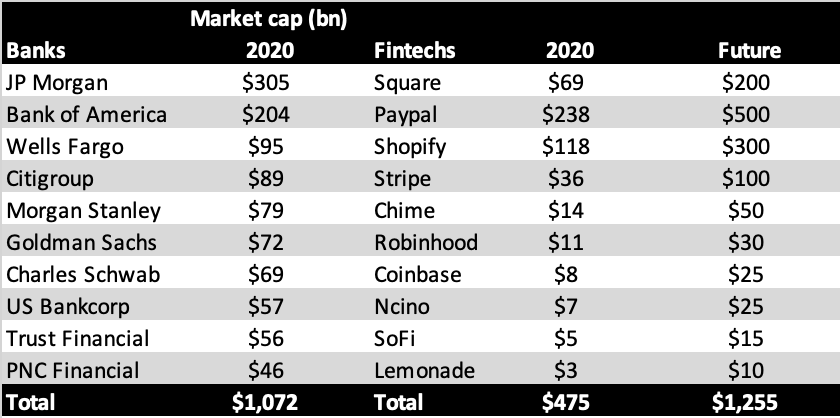

Over the next several years, we believe Square, Shopify, and PayPal—collectively valued at $425 billion today—will be worth more than the ten largest US banks combined, sitting at a little over $1 trillion.

Source: Bloomberg

Global fintech funding has grown at a 45 percent CAGR since 2011 and surpassed $100 billion over the last three years. A record quarterly high of 28 fintech mega-rounds (deals worth $100 million plus) closed in the second quarter, despite the unusual economic uncertainty. That conveys optimism. There are now 58 VC-backed fintech unicorns globally.

We expect to see a flurry of successful fintech IPOs this decade.

In July, insurance-tech Lemonade’s shares more than doubled at their market debut. NCino, a cloud-based software provider for financial institutions, saw its stock surge more than 150 percent in its first day of trading. The trend is in vogue.

Ant Group, Alibaba’s fintech arm, aims to go public this fall at a valuation above $200 billion. Chime, an American mobile-banking startup valued at $1.5 billion earlier in 2019, now sits at $14.5 billion and plans to be IPO-ready in the next twelve months.

Coinbase, Robinhood and SoFi have also expressed an interest in going public. Expect it to happen sooner rather than later.

The success of these fintech offerings will, eventually, lure even revered Stripe cofounders John and Patrick Collison to opt for a public listing. Their twelfth round of funding in April raised $600 million, bringing Stripe’s valuation to $36 billion.

Traveling forward in time, Tech Crunch contributor Nik Milanovic believes that basic financial services will become simple open-source protocols, lowering the barrier for any company to offer financial products to its customers. Financial services will be the next layer of the stack to build on top of internet, cloud, and mobile.

Essentially, nearly every company, even those that have nothing to do with financial services, will qualify as a fintech company. Today’s tech giants have a significant advantage as they consider how to leverage financial services to better serve their customers and build a moat around their business.

Apple launched the Apple Card. Amazon is offering an expanding range of financial services, including credit cards and loans to people using its marketplace to sell. Facebook unveiled its cryptocurrency-driven Libra project and launched Facebook Pay. Google is launching checking accounts and mobile banking next year through a partnership with banks. Uber and Lyft introduced mobile bank accounts and debit cards for drivers in order to improve retention.

“If these signals are indicative,” writes Milanovic, “financial services in the next decade will be a feature of the platforms with which consumers already have a direct relationship.” The corollary is Big Tech’s bull run can continue as they encroach on the traditional banking model.

No part of traditional banking seems to be out of bounds for disruption. As Bill Gates once said, “Banking is necessary, banks are not.” Death by fintech is death by the proverbial thousand cuts.

Photo: Code