We have shared a curious observation for a few years now. When the leading company in the hottest sector goes public, it usually marks an important inflection point.

The AOL Time Warner merger in 2000, still the largest ever, culminated in the dotcom bust; the Blackstone IPO in 2007 presaged the Great Recession; and Glencore’s 2011 listing marked the peak in the commodity super-cycle. As a rule, insiders sell at the top.

By this reckoning, we believed Uber’s IPO, the most highly valued US startup, would kick off Silicon Valley’s endgame. “The longer Uber stays private,” we wrote in June 2016, “the longer the length of this bull market.”

Uber went public on May 10, 2019. Then its shares quickly fell over 40 percent. WeWork’s listing was pulled. A fair few unicorn valuations cratered. For a time, it appeared Silicon Valley’s party was ending. Our call captured imagination, but we were wrong.

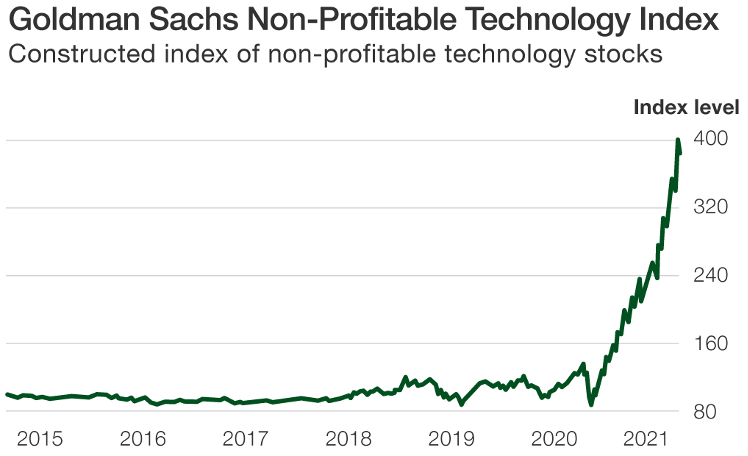

The Nasdaq kept rallying, gaining 26 percent by the time the pandemic struck. It is up 70 percent since Uber’s IPO. Shares of non-profitable tech companies have more than tripled.

Source: Goldman Sachs

There were a few things we missed.

First, at the IPO Uber fetched a valuation of $82.4 billion, less than the $120 billion it sought. The stock traded down more than 7 percent on the first day of trading. Over two-thirds of the $29.5 billion in equity that Uber had raised was underwater.

Second, Travis Kalanick, who built Uber into a ride-hailing giant, was ousted after a series of management scandals. He asked Uber’s board if he could help ring the opening bell when the share debuted on the New York Stock Exchange, but CEO Dara Khosrowshahi denied his request.

Third, Uber went public from a position of weakness, not strength. The company tapped out the available pools of private capital whilst pressure from investors to monetize their stake reached a fever pitch.

Upon reflection, this is a somber tale, not one of roaring animal spirits reflecting a peak in social mood.

Source: Getty Images

Around the same time Uber was launching its services in San Francisco in 2010, two wunderkind brothers from a small village in Ireland, Patrick and John Collison, dropped out of MIT and Harvard, respectively, to start Stripe. They began laying the foundation for a new, simpler internet payment infrastructure.

Stripe operates like a white-label merchant account, processing payments, checking for fraud, and taking a fee on every transaction. “They are a 3 percent tax on the future of the internet,” comments tech observer Benedict Evans. Over a million customers, from startups to many of the world’s biggest companies, offloaded their entire payment process to Stripe’s cloud-based system.

By becoming the standard for online financial transactions, Stripe benefits from the secular growth of digital commerce versus physical commerce. The pandemic accelerated the process: half of Americans who bought something online in the past year did so via Stripe. The payment processing platform handled almost 5,000 transactions a second.

Unlike the charges Uber fielded for fostering a misogynistic bro culture, Stripe’s apparent humility and openness sparks adoration. The thirtysomething Collison brothers are seen as visionaries with a strategic mindset on par with technology’s greatest leaders. “They’re right at the top of the pecking order in the Valley,” says Aaron Levie, the CEO of Box. Mike Moritz, a partner at Sequoia, calls the duo “humble and well-rounded.”

Source: Inc. Magazine

Stripe is now the most valuable unicorn in the US, raising new funding this week at a $95 billion valuation. The business has raised almost $2.5 billion since inception and ardently ruled out plans to go public.

“We keep telling people that we have no plans to IPO and they still don’t really believe us,” says John, who is president. “No matter what interview I’ve ever done, I’ve always managed to get a question on this, and my answer is always the same. We’re still quite early in Stripe’s journey and investing heavily in future growth ... Everyone is going public, which I realize might make us contrarian in Silicon Valley.”

The time to turn bearish is when even the most conservative and contrarian-minded get sucked in. We believe soaring stock prices and an explosive IPO market will eventually compel even the circumspect Collison brothers to opt for a public listing.

And if the past is any guide, Stripe’s highly anticipated flotation may well ring the bell at the top. What could mark the peak in internet valuations better than when the company whose grandiose mission it is “to increase the GDP of the internet” goes public?

Photo: Stripe