It’s nearly over. Omicron is hurling the world into the pandemic endgame. History teaches us that pandemics end when herd immunity is achieved through natural infection or vaccination.

For some, Omicron arrived at an opportune time, just as they were gearing up for a holiday-filled winter. The seven-day average for newly reported cases globally surged to 3.4 million on January 26 before inflecting lower. Given Omicron’s quick spread and the difficulties with testing, this is most likely a fraction of the true number.

Estimates based on Institute for Health Metrics and Evaluation (IHME) models suggest that around mid-January, there were 125 million daily Omicron infections worldwide. That’s more than ten times the peak of the Delta wave in April 2021 and suggests that more than 50 percent of the world will have been infected with Omicron by the end of March.

Virginia Pitzer, an epidemiologist at Yale’s School of Public Health, estimates that 90 to 95 percent of the US population will have had some experience with the spike protein when the Omicron wave subsides. New infections in the US have fallen 80 percent from the high-water mark, and 35 percent globally. Billions of people have some degree of immunity to the virus because of prior infections and vaccinations.

More than 62 percent of people around the world have gotten at least one vaccine dose. By the summer, that figure will have risen to 75 percent. And while overall vaccination rates in wealthy countries is vastly higher than in developing ones, it’s sufficient for the world to accept that we are no longer in the crisis phase of the pandemic. The new coronavirus will become endemic—a recurring part of our lives like its four cousins that cause common colds.

The virus is now less fatal than the regular flu for nearly every age group. Many hospitalized Covid patients have no respiratory symptoms; they were admitted for other reasons—a heart attack, a broken hip, cancer surgery—and happened to test positive for the virus. Those who become critically ill after becoming infected have a better chance of recovering thanks to therapeutics. Pfizer and Moderna plan to have Omicron-specific booster shots available by March.

The implication is that the pandemic’s severe economic and health repercussions are largely behind us. President Biden has called for a shift in national strategy to support a “new normal” of living with Covid. The era of extraordinary measures aimed at containment is drawing to a close amid growing public fatigue over restrictions.

Denmark has become the first EU country to lift all its domestic covid restrictions. Despite cases remaining relatively high, the authorities say the virus is no longer a “critical threat.” The UK has done the same. France, Greece and Portugal have relaxed travel rules. Australia opened its border for fully vaccinated tourists and all visa holders almost two years after its borders were first closed.

Source: Associated Free Press

Our job is not to predict the future; it’s to see the present clearly. Everything we observe indicates that the pandemic is nearing its end. This is bullish for the leisure and travel industry, which is edging up to 70 percent of its pre-pandemic activity.

Disney reported its best quarter ever for revenue from its domestic parks and resorts, with all its parks open during the fourth quarter despite the Omicron surge. Both Uber and Lyft said trips to the airport more than doubled from last year. TSA checkpoint travel numbers have almost recovered to the pre-pandemic levels.

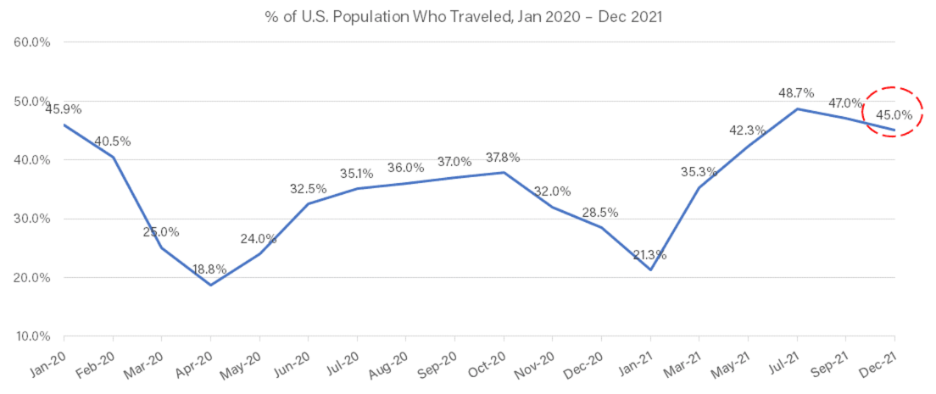

Skift Research estimates that 45 percent of Americans traveled in December versus 29 percent in December 2020 and 46 percent in January 2020 before the pandemic set in. Nearly 6 percent of all December trips were to another country, marking the highest rate since the pandemic started. Looking ahead, Americans are optimistic about traveling even more.

The year 2021 was the second-worst year on record for global tourism, with international arrivals down by 73 percent, a mere 1 percent increase over 2020. According to estimates from the International Air Transport Association (IATA), global commercial airline passenger revenue is expected to grow by 67 percent in 2022, though that is still 38 percent below 2019 levels.

We’re bullish on hotels, airlines, and online travel agencies. All signs point to a big year for travel.

Source: Skift Research

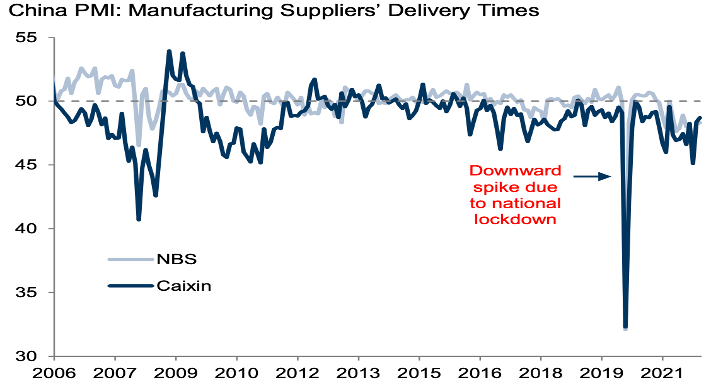

What about China? Won’t Omicron’s high transmissibility severely test China’s zero-tolerance strategy, forcing officials to enact even more extreme lockdown measures? The fear is for more global supply disruptions.

In reality, supply chain disruptions have tended to be very limited over the course of the pandemic, with the exception of the initial nationwide lockdown in early 2020. Delivery times have remained mostly within historical ranges. While China has experienced multiple episodes of local outbreaks, supply disruptions are localized and limited to certain products. We think the Beijing Olympics and the CCP’s 20thParty Congress set for autumn 2022 will conspire to prevent another nationwide lockdown.

A new supply-blockages measure developed by economists at the Federal Reserve Bank of New York showed a record level of strain in November, but things eased in December and January, which they said “seems to suggest that global supply chain pressures, while still historically high, have peaked and might start to moderate somewhat going forward.”

The International Monetary Fund estimates that supply-chain problems knocked between one half and one full percentage point off global economic growth in 2021, while pushing inflation higher. A more benign virus outlook may ease pressure on the goods supply chain while a faster normalization of services activity could help cement the shift away from goods consumption and relieve some of the inflationary pressures that come with it.

In industries where workers have been hesitant to return, the perception of lower risks may alleviate some of the labor supply constraints. As a result, wage growth may moderate. And there may be scope for markets to price rate hikes at a slower pace than they are now. What do you suppose investors will do to commemorate the occasion? We could be on our way to new stock market highs in no time.

Source: Goldman Sachs