Coal and oil-fired power plants are back online across Europe. Germany built a new liquified natural gas (LNG) terminal in a record ten months. The UK approved its first coal mine in thirty years. Has the energy transition been overturned?

No. It’s just the opposite.

Europe hasn’t traded-in its green credibility for energy security. Russia’s invasion of Ukraine, rather, has emboldened its move away from fossil-fuels. On top of phasing out coal, the focus now is on rapidly cutting gas demand.

A deluge of clean energy spending is coming. The investment zeitgeist of the decade is the race to zero emissions.

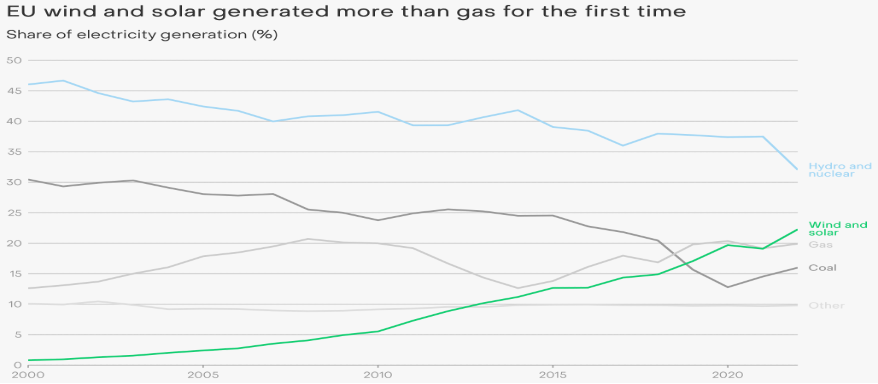

For the first time ever, renewables accounted for a greater share of the EU’s electricity production than fossil fuels.

In 2022 wind and solar generated a fifth of the continent’s power, or 22 percent, overtaking the 20 percent generated by natural gas, and comfortably bypassing coal’s 16 percent share. Hydro and nuclear accounted for the rest. Solar grew a record 24 percent on its own as twenty EU countries relied on it more than ever.

High prices and demand constraints limited gas-based power generation, while coal’s resurgence was overblown. Its share rose by a mere 1.5 percent. Were it not for the 1-in-500-year drought that restrained hydro, or the unexpected nuclear outages in France resulting in the lowest output in thirty years, coal’s contribution would have likely fallen.

Nine of the twenty-six coal units brought back on emergency standby provided zero generation, with the rest running at 18 percent of capacity. Higher coal imports were stockpiled, and not burnt, indicating the purchases were preventive.

According to Ember, an independent energy think tank, fossil fuel electricity generation across the EU will plummet by 20 percent in 2023, nearly double the record 11 percent drop seen in 2020 when the pandemic struck. Gas generation will fall the fastest.

Source: Ember

Clean energy proved resilient and the key to Europe’s energy security. Reducing fossil-fuel dependence further to achieve climate change objectives is now almost existential. And Brussels isn’t holding back.

“The road to net-zero means developing and using a whole range of new clean technologies across our economy: in transport, buildings, manufacturing, energy” insisted Ursula von der Leyen, head of the European Commission (EC), from Davos. “The next decades will see the greatest industrial transformation of our times—maybe of any times.”

The EC has already begun to make it happen, fast-forwarding its energy transition through its REPowerEU plan. It aims to accelerate renewable energy to 45 percent of the EU energy mix by 2030, up from 40 percent now. The first EU-wide hydrogen projects have been approved along with additional solar and wind and an increase in biomethane production.

The focus is also on more ambitious energy savings. Reduced fossil fuels for homes, buildings, industry, and power systems underpin stringent energy efficiency targets, and industrial decarbonization projects will be frontloaded using the EU’s Innovation Fund.

At the national level, policymakers are racing towards zero emissions. “Ultimately, our goal of achieving carbon neutrality by 2045 has been given an additional boost by Putin’s war”, said Olaf Scholz, the German Chancellor. “Now we have even more cause to move away from fossil fuels.”

Renewables already accounted for half of Germany’s electricity in 2022. To further add to its clean energy mix, Berlin has announced a plan to build a large-scale hydrogen pipeline between Germany and Norway by the end of the decade. The pipeline will initially transport blue hydrogen produced from natural gas, later transitioning to green hydrogen produced with renewables.

Although Greta Thunberg was arrested at a protest over a coal mine expansion project in North Rhine-Westphalia, the government’s temporary allowance of slightly more coal led it to bring forward the coal phaseout by eight years to 2030.

Data from the German EV auto market also points towards a hastening of the energy transition. This past December total plug-in electric vehicles sales—the combination of hybrids, plug-in hybrids, and fully electric cars—accounted for over half of all sales in Germany. And Germans bought more new electric vehicles than conventional ones in 2022.

Source: Reuters

France, where nuclear accounts for almost 75 percent of electricity production, isn’t standing still either. “What our country needs,” declared President Emmanuel Macron confidently, “is the rebirth of France’s nuclear industry. Certain countries have made the extreme choice of turning their back on nuclear energy. France has not made that choice.”

Macron wants to streamline rules for building reactors. Previous governments sought to restrain nuclear power, but in a bill making its way through the French parliament, nuclear’s share would be maintained above 50 percent of production by 2050.

With a target of fifty offshore plants by 2050, up from merely one today, the country aims to generate 40 gigawatts of electricity while multiplying solar capacity by ten times to 100 gigawatts.

Eyeing France’s success with nuclear, Sweden outlined a partnership with experts in Paris for two new nuclear reactors. “The new Swedish government is determined to build new nuclear power plants and we are very impressed by the French experience,” said Prime Minister Ulf Kristersson in a meeting with Macron.

The Netherlands, Belgium, Denmark, and Luxembourg are reinforcing their green bona fides as well. Together they’ve called for stronger 2030 emissions targets for trucks and buses, as transport accounts for nearly a quarter of EU emissions. This aligns with the EC’s deadline for all new cars to emit zero CO2 emissions by 2035.

Source: Foreign Policy

Across the Atlantic, where renewable energy accounts for just 15 percent of electricity generation, the inflationary shock from Putin’s war has also resulted in a call to arms on renewables. “The world needs to treat climate change like World War II,” proclaimed John Kerry, US President Joe Biden’s top climate envoy, at the World Economic Forum.

Rhetoric this passionate has been matched by never-before-seen levels of funding for the energy transition in America. Last year, through its Inflation Reduction Act (IRA), the US accelerated its goal to cut greenhouse-gas emissions to 40 percent below 2005 levels by 2030. To get there, the IRA armed the Department of Energy with a war chest of more than $350 billion.

The IRA provides significant incentives for the energy transition in two key ways: by bringing longer-term certainty into the development of renewable energy projects and by offering tax breaks per unit of production for cutting-edge decarbonization technologies.

Through $260 billion in tax credits, grants, loans and supporting policies, the act supports relatively mature sectors such as solar, wind and nuclear while jump-starting carbon capture, usage and storage, clean hydrogen, and other frontier technologies.

And while the legislation neglects to require companies to reduce their emissions, it includes tax incentives for firms to invest in renewable energy and rebates for consumers who buy EVs or invest in energy-efficient home improvements.

Source: Reuters

Russia’s war on Ukraine has acted like an accelerant on the energy transition. The global commitment is unprecedented, and a flood of spending on renewable energy is on its way. It is anticipated that it will cost more than $3 trillion per year for the next thirty years to reach the 2050 net zero targets.

This is how to invest:

(1) Energy has been the performing equity sector for the past two years. This is going to change. In fact, since October, renewable ETFs such as iShares Global Clean Energy (ICLN) and Invesco Solar (TAN) have outpaced energy stocks by 11 percent and 19 percent, respectively.

(2) You can’t electrify the entire planet without huge amounts of metals such as copper, aluminum, steel, lithium, and cobalt. The metals intensity for renewable energy is over ten-times greater than for coal and gas-fired power plants. We’re bullish on commodity miners: Alcoa (AA), Freeport-McMoRan (FCX), and US Steel (X).

(3) Industrial companies tied to capex spending on climate change, reshoring, electrification, and decarbonization projects will benefit during the energy transition. Of note, Caterpillar (CAT) is hitting all-time highs despite all the recession talk. Cummins (CMI) is getting close.

(4) Uranium prices are in their third structural bull market since the 1970s, holding steady at around $50 per pound. The world has finally realized that a substantially larger nuclear component is required for an orderly, economical, and politically viable transition to zero-carbon electricity. This is good for uranium equities.

(5) In the US, over 10 percent of the electrical grid is a hundred years old, 60 percent of distribution lines have exceeded their life expectancy, and 90 percent of transformers are nearing the end of their useful lives. A big upgrade to the US power grid is needed to meet the upcoming surge from electrifying the US vehicle fleet.

Electrifying just the long-haul portion of the US trucking fleet would gobble 10 percent of the nation’s electric power generation, according to the American Transportation Research Institute. And electrifying all cars and trucks would need 40 percent of the grid output.

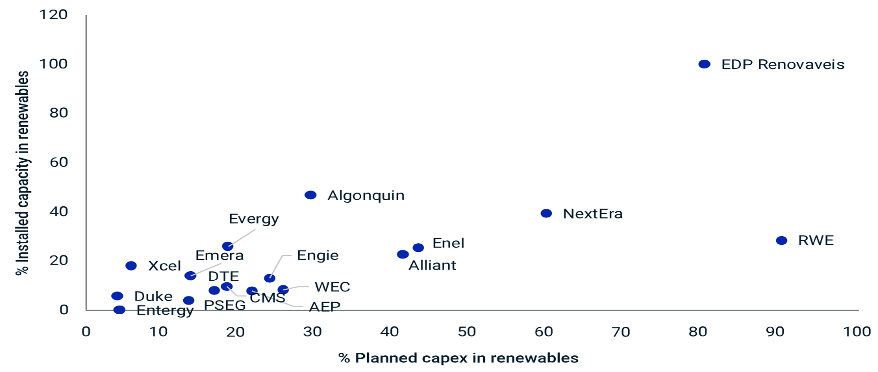

We like having exposure to the utility capex cycle. Significant investment in transmission and distribution infrastructure will be a major factor in meeting US emission reduction goals. NextEra is the largest utility in the S&P 500 and a leader in low-cost renewables and energy storage.

Utilities with high planned renewable capex

Source: MSCI