Our dinner in Greenwich, the preferred lush suburban haven of Wall Street, was unlike any other. We gathered in the home of the most successful trader of our era.

Jeff Koons’s Balloon Dog sculpture adorned the driveway. Inside, the walls were festooned with paintings from his fabled collection of impressionist and contemporary art, which would make many museums envious.

As is customary at our events, each attendee was requested to bring a chart to discuss with the group. Please find a summary of the charts and discussion below.

Chart 1: Long Skynet “ChatGPT is as important as the iPhone, a Tesla, or AWS.”

Chart 2: Short Anomalies What is happening that shouldn’t be and what is not happening that should be?

Chart 3: Long Aernoautics What happened to the assured recession which most models, surveys, and leading indicators have been pointing to?

Chart 4: Short Hunger “A successful transition from fossil fuel dependency to renewable energy presents the first truly global problem that humanity has faced.”

Chart 5: Long Makeover “With EV and renewable energy penetration rates accelerating, our country’s electric utilities need a massive makeover.”

Chart 6: Long Carnivals The Greek stock market is ripping. The Mexican peso is on the best run in a decade. Macau’s casino stocks more than doubled in three months. What’s going on?

Chart 7: Short Liars “A redeeming arc of history is that dictators end up believing their own lies, and their cronies rarely tell them hard truths.”

Chart 8: Long Scars “We are all just a car crash, a diagnosis, an unexpected phone call, a newfound love, or a broken heart away from becoming a completely different person.”

Long Skynet

Source: Our World in Data

“ChatGPT is as important as the iPhone, a Tesla, or AWS,” the speaker said, all of which were defining moments in his investing career that led him to shift his portfolio in a meaningful way. Chat GPT has the steepest adoption curve of any prior innovation, taking only five days from its launch to get to 1 million users.

“What has made AI so much better (and allowed for these tools to reach human performance) is that today’s models are 700x larger than 6-7 years ago and 40x larger than 3 years ago,” he continued. “They consume much more compute (CPUs, GPUs, FPGAs, DPUs), memory (DRAM, NAND), and storage (SSDs, HDDs).”

A ChatGPT answer uses 100x the computing power as a Google search, and OpenAI’s compute usage could be compounding at 50 percent per month. Datacenter semiconductors providing this computing power will substantially benefit from Generative AI, according to the speaker. He’s bullish on AMD and Marvell, both of which are now his top positions. Nvidia is also cheap on a long-term basis and a small position for him.

As a sign of this new frenzy, venture capitalists are paying steep prices for AI startups that are little more than ideas. The speaker thinks that is foolish. The costs needed to run AI models are steep and they’re competing with deep-pocketed tech incumbents who will capture most of the value being created.

Big Tech companies like Google, Microsoft, Meta and Amazon are the leading publishers of academic research on AI, and they are increasing their investments in AI technology, from $18 billion in 2016 to $94 billion in 2021.

Google declared an internal “Code Red” about ChatGPT, which is evidence of how disruptive it could be. The problem is that “Google suffers from the resource curse,” the speaker noted. They have dominated search for the past two decades with 93 percent of the global search engine market. Sitting atop a $100 billion economic monopoly created corporate bloat and led innovation to stagnate.

“Google X is a disaster,” one of the participants shared, who sits on the advisory board. “The whole company can probably be run by just 10 percent of its nearly 200,000 workforce.”

The speaker also highlighted the potential for dispersion in semiconductors as different end markets are performing so uniquely. While the datacenter names are facing a demand shock from Generative AI, industrial semiconductors are still over shipping compared to demand. “If there’s a recession,” he said, “industrial and automotive companies will likely get hit hardest.”

Short Anomalies

Source: LTS One

“While everyone talks about the housing shortage—there are 46 percent fewer homes on the market than in 2019—the reality is that the supply of houses under construction is near an all-time high,” said the speaker.

Single-family homes under construction are well below the 2006 housing bubble peak, and not nearly enough to meet continued demand from Millennial and Generation Z buyers in their peak nesting years. However, the number of multifamily housing units under construction is at the highest level since November 1973. More than double at the peak in 2006.

Multifamily construction boomed in 2022, up 15 percent from the previous year and exceeded a 500,000 annual pace—the first time since the Great Recession. The National Association of Home Builders is projecting that multifamily starts will fall 28 percent this year to a 391,000 total and will stabilize in 2024 at about 374,000 starts.

“While not perfect substitutes, more multifamily units matter for the supply and demand of the single-family housing market,” he added. “So, while the finished inventory is low, the pipeline is the opposite. This poses a risk to home prices.”

Home prices soared by 42 percent between February 2020 and their peak in June 2022. Meanwhile, the minimum income needed to afford a typical house has doubled since 2020 in several major metro areas.

The speaker is short homebuilders. A few participants shared his opinion and were also short housing related stocks like Home Depot.

“The beauty of macro investing is to look for anomalies,” said a participant. “What is happening that shouldn’t be and what is not happening that should be?”

“The housing crash many predicted hasn’t happened yet. Prices are higher than they were a year ago, and mortgage applications are rising again even with obvious affordability challenges.

The jump in mortgage rates to 5 percent cooled off the housing market. But given strong employment and rising incomes, we are seeing the housing market stabilize with mortgage rates still above 6 percent. That’s incredible.”

Mortgage rates surged in 2022 but mortgage debt service payments are historically low relative to disposable income. And mortgage buy-downs from sellers, homebuilders or even lenders are cushioning the rate shock. Home buyers might get 2 percent off the mortgage rate for the first year, and 1 percent off for the second year, before reverting to the permanent rate in year three.

Odds of a housing crisis are extremely low. Almost all outstanding mortgages have rates fixed well below prevailing rates, borrowers have higher credit scores, and most US homeowners are sitting on a mountain of home equity. Even a 15 percent drop in prices would leave only 3.7 percent of households underwater, compared to 28 percent in 2011.

Homebuilders bottomed in June—before the stock market low in October—and are up nearly 50 percent. It is the best performing group despite a meaningful increase in interest rates. This is an anomaly.

“The market is telling all of you you’re wrong,” he warned. “It is worth paying attention to the signal.”

Long Aeronautics

Source: Haver Analytics

More typically, job losses in recessions have centered around goods-producing sectors, such as manufacturing and construction. But the pandemic-induced recession was quite different. Job losses were concentrated in service sectors.

Past recessions also disrupted employment from the demand side. Job openings took years to recover.

Following the Great Recession, it took 49 months for leisure and hospitality employment to exceed its December 2007 level; 58 months for professional and business services jobs to recover; and 88 months for the retail sector to reclaim its employment peak.

But there are already 2.6 million more people employed today than pre-pandemic. Job openings are 11 million compared to 7 million in February 2020. There was a huge positive demand shock and the service sector, which makes up 80 percent of total employment, remains underemployed.

“We can’t have a recession given this dynamic,” said the speaker. “Aside from the tech sector, everyone is looking to hire.”

It is not a given that the housing market downturn will spread to the rest of the economy. Even in the construction industry, there are nearly twice as many job openings as there were in the mid-2000s. That leaves a lot of room for the labor market to weaken before it leads to a significant rise in joblessness.

The construction industry averaged more than 390,000 job openings per month in 2022, the highest level on record. National payroll construction employment was 231,000 higher in December 2022 than in December 2021.

After the mid-2006 peak in construction activity, it took another eighteen months for construction unemployment to rise in a meaningful way. The backlog is bigger today; the labor shortage is worse due to retirements and a lack of immigration; and if there are layoffs in the single-family housing industry there is offsetting demand from multifamily and the projects funded by all the infrastructure spending approved by Congress.

Only when the backlog of units under construction clears, housing demand slows sharply, and we start to witness a rise in construction unemployment does the risk of a recession increase. That is probably not going to happen until well into 2024.

As of now, the unemployment rate is lower than any month since the 1960s. The economy is expanding. Real disposable income is growing. Consumer spending is strong. Even housing seems to be rebounding. The number of companies with earnings estimates being revised higher is climbing.

“Why all the pessimism then?” asked a participant. “What happened to the assured recession which most models, surveys, and leading indicators have been pointing to?”

“Everyone has a playbook: something breaks when the Fed hikes rates aggressively,” said the speaker. “But the playbook is not working. Rather than being flexible and adaptive, most people are stuck in their thinking. Many investors are still offside.”

The speaker expects relatively shallow corrections as the stock market continues higher.

Short Hunger

Source: Xinhua

“Humans periodically bring catastrophe upon themselves,” said the speaker. “Wars, revolutions, civil conflicts. The more irreconcilable the differences between parties to a conflict, the greater the catastrophe. That’s why when there is a conflict between religions, races, or political ideologies, the consequences can be outd.”

“Some of our great catastrophes, however, are caused by policy in the absence of war,” he asserted. “China’s Great Leap Forward in the late 1950s is an example.”

Well-meaning policies, developed by intelligent people, led to a catastrophe that produced an estimated 40-50 million deaths of Chinese citizens. It was entirely self-inflicted. As the consequences could no longer be denied, policy changed, and the nation was able to gradually recover.

It is easy to be critical of Chinese leadership during that period, just as it is easy to be critical of leaders who provoke catastrophic wars. But it is important to recognize that it is most often the case that the vast majority of political leadership is behind such decisions. Usually the population is also aligned, particularly after succumbing to the power of propaganda.

The speaker was afraid that we are walking into a unique manifestation of this kind of catastrophe, albeit on a global scale. Some aspects of the dangers ahead are easy to foresee, although he expects many others that will surprise us in the coming decade.

The Paris Agreement acknowledged that limiting global warming to 1.5 degrees celsius requires rapid, deep and sustained reductions in global greenhouse gas emissions, including reducing global carbon dioxide emissions by 45 percent by 2030 relative to the 2010 level and to net zero around midcentury, as well as deep reductions in other greenhouse gases. Achieving the target is not guaranteed, however, as emissions in the year 2030 will be 14 percent higher than in 2010 given existing pledges.

“A successful transition from fossil fuel dependency to renewable energy presents the first truly global problem that humanity has faced,” he argued. “It is incredibly complex and requires global political coordination and investments on a scale never seen.”

A general failure in recent decades to address climate change has produced a leadership vacuum. Climate activists, governments, corporations, and investors are now tackling the issue in their own ways. Most of these actors are well-meaning. But so far humanity has produced an uncoordinated and insufficient effort to solve the problem.

Consider this: fossil fuel energy production is not responding to higher prices in the same ways that it has throughout the careers of most investors and politicians. Such a shift in the reaction function is hard for most people to process. We see it in Western oil producers earning record profits, which they are using for share buybacks as opposed to investing in new production.

Chevron tripled its budget for share buybacks to $75 billion. ExxonMobil’s CEO described its $50 billion share buyback scheme as returning some money “directly to the American people.” President Biden has accused oil companies of “war profiteering.”

And there are other important commodities whose production is not responding to higher prices in typical ways, including food and fertilizer. The constraints to supply this will create are amplified by the Ukraine war and deglobalization trends.

The speaker points out that the general policy response in many wealthy countries has not been to rapidly increase supply, but rather to subsidize consumption of energy and food.

Subsidies for oil, gas and power reached more than $1 trillion as governments looked to help shield consumers from last year’s price spikes. That's more than double 2021 levels. This pushed the shortages and high prices to the poor countries.

He looked worried: “While this is impossible to forecast with any certainty, the world appears at risk of a Great Leap Forward type of famine, although perhaps on a far larger scale.”

A 2022 report by the Environmental Defense Fund forecasts that under a moderate emissions scenario, the US will see “significant climate burdens” on crop production in the Midwest as soon as 2030.

Pests and diseases are responsible for between 20 percent to 40 percent of losses to global crop production, according to the United Nations’ Food and Agriculture Organization. Warming temperatures are increasing the risk of plant pathogens and pests spreading into new ecosystems.

The speaker continued: “The crisis of leadership in the Great Leap Forward affected China’s population and forced a Chinese policy shift. In this case, the uncoordinated policy that is leading to this global threat is emanating from the nations who will not bear the ultimate humanitarian costs, and therefore it is possible that this could persist far longer than it did in China.”

His focus now is on making influential people aware of this risk so that we can hopefully adjust policy preemptively and prevent the catastrophe from happening.

Long Makeover

Source: Bloomberg New Energy Finance

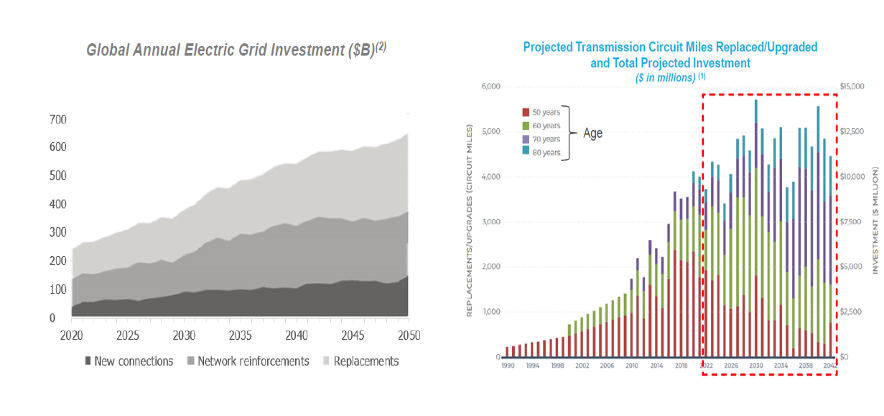

“The transition to net-zero won’t be cheap,” stated the speaker. In the last year, over $1 trillion of fiscal spending programs have been announced, including the $550 billion Infrastructure Investment & Jobs Act, the $200 billion CHIPS Act, and the $600 billion Inflation Reduction Act.

Additionally, the private sector announced $1.3 trillion of reshoring and energy transition projects, including new semiconductor fabs, electric vehicle manufacturing plants, charging stations, giga-factories, and solar manufacturing facilities. Project backlogs are increasing at an accelerated pace, setting the stage for a multi-year capex cycle.

The utility capex cycle was given particular attention by the speaker. “With EV and renewable energy penetration rates accelerating, our country’s electric utilities need a massive makeover,” he claimed. In the next thirty years, $14 trillion of grid investment and 100,000 miles of transmission line upgrades will be required for the energy transition.

He owns a basket of industrial companies geared to the utility capex cycle including Eaton, Quanta and Wesco. They possess a trifecta of growth, earnings visibility, and discounted valuations which should drive share price outperformance in a challenging economy.

“What do you think about commodity miners?” a participant asked. “Aren’t they also major beneficiaries of the energy transition capex cycle?”

The speaker agreed. He’s bullish on copper. Inventories are at twenty-year lows in absolute terms and all-time lows on a days of supply basis. Copper deficits will intensify given demand growth should exceed three million metric tons this decade.

“These companies have generated insane amounts of cash in the last three years,” he noted. “The book value accretion puts a higher floor under the stocks. And if you actually graph enterprise value (instead of equity value), the bull run looks less dizzying and you’re still buying them cheap-ish.”

Long Carnivals

Source: FactSet, Datastream, Haver, GIR

The Greek stock market is ripping. The Mexican peso is on the best run in a decade. Macau’s casino stocks more than doubled in three months. What’s going on?

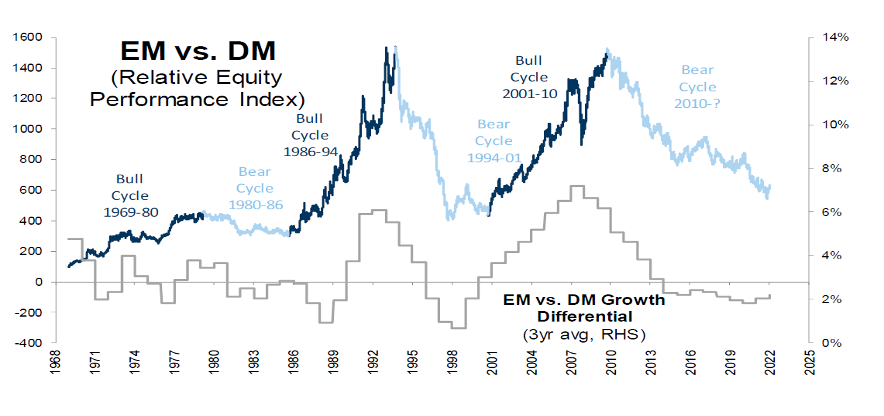

Thanks to a rare combination of attractive valuations, elevated yields, decelerating inflation, a weaker US dollar, and the potential for higher growth in China, the speaker reckoned the outlook for emerging markets (EM) assets is now better than it has been for several years.

After the commodity super cycle ended in 2011, the economic growth differential of EM over developed markets (DM) moderated and fell below the long-term average. Consequently, the MSCI EM index returned just 2.9 percent a year in the past decade, compared to 9.5 percent for developed markets.

Historically, sustained EM outperformance has been driven by superior earnings per share growth. While there is fear the next leg lower in US stocks will be driven by negative estimates revisions, the earnings revisions for EM in the coming year have moved into positive territory.

EM stocks are trading at a 35 percent and 44 percent discount to DM on PE and PB terms, respectively, the cheapest discounts in nearly two decades. The superior dividend yield (3.3 percent for EM versus 2.1 percent for DM) is three standard deviations above the 23-year average relative yield.

Encouragingly, EM currencies outperformed during the most recent bout of dollar strength, even as EM debt suffered record outflows of more than $87 billion in 2022, which equates to over 10 percent of the asset class.

“Brazil is best positioned,” said the speaker, given its commodity exposure and burgeoning middle class. “Fears around President Lula are genuine, but don’t forget that he was also the country’s left-wing leader from 2003 to 2011 when Brazil was a dream trade. The setup today is quite similar.”

Brazil was one of the world’s first central banks to embark on an aggressive tightening cycle, moving in 2021 to take its benchmark Selic rate from historic lows of 2 percent to 13.75 percent by September 2022. According to the speaker, a favorable interest rate cycle is upon us with the interest rate expected to be cut to around 7 percent in the coming year. Inflation stood at 5.7 percent in January after reaching a peak of 12 percent. He likes Brazilian equities and credit.

Short Liars

Source: Ergo

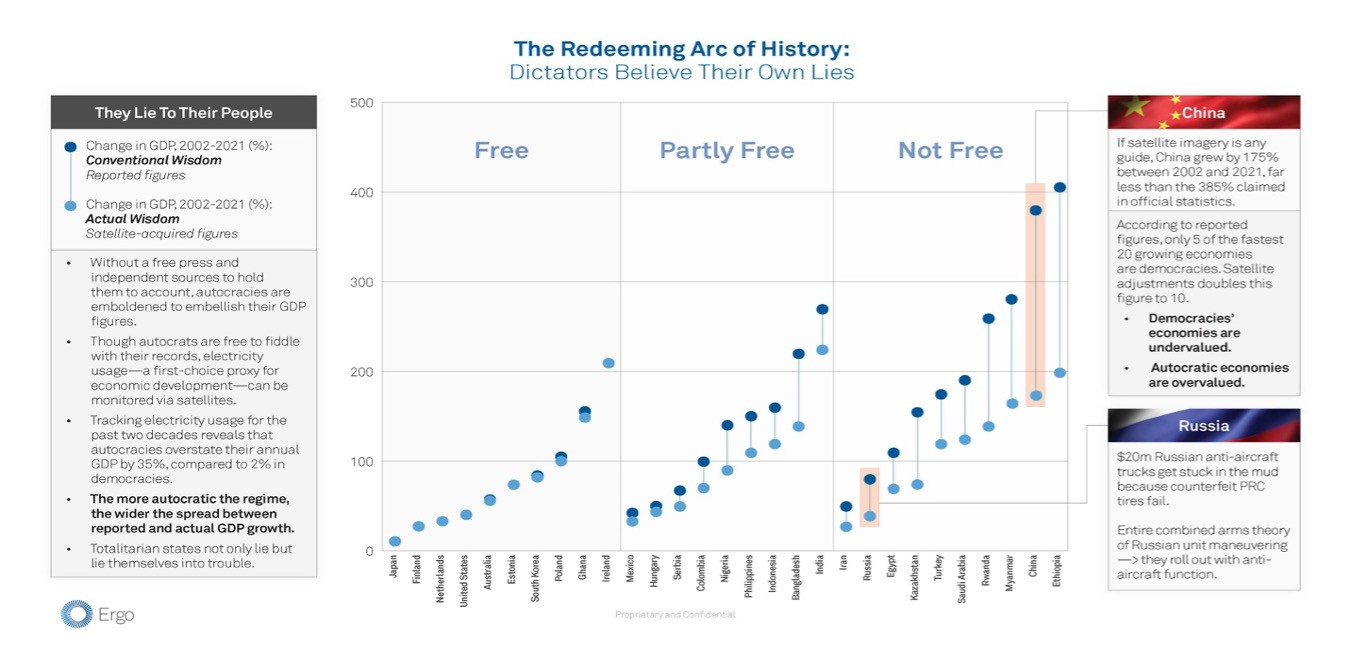

Without a free press and independent sources to hold them to account, autocracies are emboldened to embellish their GDP figures. However, the speaker noted that electricity usage—a first choice proxy for economic development—can be monitored via satellites.

Tracking electricity usage for the past two decades reveals that autocracies overstate their annual GDP by 35 percent compared to 2 percent in democracies.

“What happens when Chinese fundamentals are revealed to be so far removed from Chinese official data?” the speaker probed. Looking at satellite imagery, China grew by 175 percent between 2002 and 2021, considerably less than the 385 percent claimed in official statistics.

“The more autocratic the regime, the wider the spread between reported and actual GDP growth,” he added. “A redeeming arc of history is that dictators end up believing their own lies, and their cronies rarely tell them hard truths.”

The speaker cited the example of Russia’s $20 million anti-aircraft Pantsir-S1’s stalling because of counterfeit Chinese tires. Totalitarian states not only lie but lie themselves into trouble.

His recommendation: go long open societies and short dictators. According to reported figures, only five of the fastest 20 growing economies are democracies. Satellite adjustments doubles this figure to ten.

The speaker also urged everyone to support efforts against the disinformation bewilderment eating our democracy.

Long Scars

The speaker shared a quote by Samuel Decker Thompson:

We are all just a car crash, a diagnosis, an unexpected phone call, a newfound love, or a broken heart away from becoming a completely different person.

How beautifully fragile are we that so many things can take but a moment to alter who we are forever?

“Can you recall a time like that in your life?” he asked.

“My dad passed away when I was twelve years old,” said a participant. “Our house and car were seized, and I moved into a studio apartment with my mother. I can still picture the humiliation of going to the checkout stand at the grocery store and being forced to return items because we ran out of cash.”

“What impact did all of this have on you?” the speaker inquired. “I hated being poor,” he pronounced. “I was intensely driven to make money, so I studied hard and hustled to get the right jobs.” He now runs his own hedge fund.

A participant mentioned that when people from the subcontinent leave for college in America at the age of eighteen, they break ways with their parents forever. Work lives take over and they visit home occasionally, sometimes for only one week each year.

He was like that. He focused on professional excellence and forgot about family. That is until he lost his father. “I was in my thirties and my entire perspective shifted,” he said. “My priorities needed to change.”

He remembers individuals approaching him at his father’s funeral to express their gratitude for his father’s generosity. “He was incredibly charitable,” the participant reflected. “His modest donations made a huge difference in so many lives. It enshrined in me the value of giving back.”

“My mom was diagnosed schizophrenic when I was quite young,” a participant shared. “Then one day she stopped taking medicines. She suffered a number of nervous breakdowns and left the house; she just roamed for twenty years. My parents divorced.”

“What I remember most vividly was how I was forced to grow up. Do I continue to be a child, reacting to what’s happening around me? Or do I take control of my life, come what may? I was angry and determined when I left my small Indian town and came to study in America.”

After a successful career at Goldman Sachs, he launched his own hedge fund in 2014 backed by some of the world’s top investors. “All the volatility in my personal life actually made me calm in my trading,” he said.

But the past caught up to him. He could no longer numb the feelings of guilt and shame: “Did I do something wrong? Did I abandon my mom?” He was forced to examine his life and come to a decision.

As his mother’s mental illness was slowly taking bits of her away, he decided to return money to investors and return to India to be with her. “It was the best decision of my life,” he remarked. “There is no way I could replicate that success in markets or experience the same sense of achievement.”

After a long sabbatical, he is now back to managing money, feeling unburdened and with a clear head, having escaped the market’s tyranny in 2022.

“For me it was 9/11,” shared the next participant. After chasing Osama bin Laden for many years as director of counterterrorism at the National Security Council, he felt a “profound sense of failure” because he was unable to prevent the loss of three-thousand lives.

“That fateful Tuesday I was going to have lunch with my good friend and mentor John O’Neele,” he continued. O’Neele was chief of the FBI’s counterterrorism section before accepting the role of chief of security at the World Trade Center in August 2001. He was the bureau’s most committed tracker of Osama bin Laden.

O’Neele called the participant after the American Airlines Flight 11 crashed into the north tower: “Can you believe he found me here?” O’Neele died rescuing people as the towers came crashing down. The participant raced to be with him but it was too late.

“On that day I woke up to evil in this world,” he admitted. “I started living a mission-driven life. I wanted to prevent future disasters—from cyberattacks to pandemics—by noticing the invisible obvious.” He later founded a prestigious global intelligence firm, and in 2017, correctly warned about a coming pandemic.

“My parents had the most dysfunctional relationship, and the divorce went horribly wrong,” a participant revealed. “I’m the oldest of six children, and at the age of fourteen, I was put in the terrifying position of having to choose one parent over another.”

He still can’t believe that was allowed back then. Children already have to deal with the hurt, sadness, and anger that come with a parent’s divorce; adding a heated custody battle on top of that is overwhelming.

“I made my choice,” he said, choosing for all of his siblings to live with their mother and stepfather. “To ensure that I stay away from my father, she verbally defamed him and used emotional blackmail on me.”

As much as he desired his father’s presence in his life, they were estranged for fifteen years.

In his late twenties, the participant had had enough. He decided to get in touch with his dad. He was surprised to learn that his father was waiting for him all along. None of his mother’s inflammatory remarks were true.

“It was so easy in retrospect,” he said. “Each of us must confront our own fears. If we let them build up, they can do a lot of damage. Inaction breeds fear and doubt. The only way to deal with fear is to face it. Fear helps you develop courage.”

In October 2017, The New York Times and The New Yorker reported that dozens of women had accused film producer Harvey Weinstein of rape and sexual abuse over a period of at least thirty years.

“Seven days later,” the participant said, “The Wall Street Journal reported on the front page that I was fired for allegedly sexually harassing a junior female employee. I couldn’t believe it.”

After a great eighteen years, he resigned from the company a few weeks before on his own terms. “Rather than tell the correct story,” he lamented, “the company corroborated the reporter’s version that I was fired for improper conduct.”

“It was the roughest time in my life,” he said. “I’ve never felt more alone.”

Nearly two years later, as he met with investors to raise capital for his new fund, his personal integrity was still being questioned. But it did teach him a crucial lesson: “Whenever you notice someone is going through a hard time, just reach out to them.”

It was now the host’s turn.

“There are so many moments to pick from,” he mused, “but for this group, I think it will be most interesting to discuss the investigation for insider trading. How many people have been the target of SEC’s ire?”

“I could not understand it at first, what the hell was going on, it was like a circus,” he said. “But I knew the truth: I didn’t do anything wrong.”

As the news continued to circulate he had a word with his family. “People in the company have done things that are wrong, and they’re going to pay for what they did,” he said. He warned them that they were going to hear unpleasant things about him, but he reassured them that everything is going to be fine.

Eight people were convicted of having committed insider trading while they worked at his firm (though two of those convictions were later overturned). He observed employees that had nothing to do with the investigation buckling under the stress. While that annoyed him, he himself remained confident and calm.

“How did you maintain emotional stability throughout this?” a participant asked.

“I knew the truth,” he declared firmly. “That liberated me.” To use an old quote: he felt safe in the midst of his enemies; for the truth is powerful and will prevail. After ten years of investigation, a criminal probe closed without any charges.

The government subpoenaed his emails, phone records, and instant-message logs; prosecutors and FBI agents studied his communications patterns and trades in details. They even placed a wiretap on his phone. Nothing turned up.

Legally, when an employee acting within the scope of his employment commits a crime, that crime can be attributed to the company he works for. So the SEC, out for blood, decided to indict his company instead.

“Did it not hurt your ego and identity?” inquired another participant. “That is what many struggle with in our industry.”

“No,” he said, reflecting on the question. “I’m oblivious to what people say about me. I guess back then everyone hated me; I was the hedge fund scumbag. Today everyone loves me because I own a baseball team. I’m pretty much the same guy.”

It was getting late. Some of the guests had to drive back to the city. The host concluded by saying: “We all have our scars and stories. It is what defines us and sets us apart.”