On April 26, 1956, the first shipment of containerized cargo departed from Port Elizabeth, New Jersey, for Houston, ushering in a revolution in global trade.

By hoisting no more and no less than a truck’s container into the hold of a ship, onto the flatbed of a train, or even into cargo airplanes, entrepreneur Malcom McLean became the unsung star of globalization. He could see the future unfold and said so: “People are never going to pay a lot of money just to move things.”

Prior to container shipping, two ten-mile moves through ports might account for half the costs of a four-thousand-mile shipment. Why? Because swaggering, Brando-like longshoremen had to manually transfer close to two hundred thousand items, one at a time, between ships, trucks and trains.

Inside intermodal containers, products remained stored from the point of manufacture to delivery, lowering the possibility of damage. Rather than taking weeks to unload a ship it now took hours, and the cost plummeted from $5.86 per ton to just 16 cents.

“The container made shipping cheap, and by doing so changed the shape of the world economy,” writes Mark Levinson in The Box, a comprehensive history of the shipping container. “This new economic geography allowed firms whose ambitions had been purely domestic to become international companies, exporting their products almost as effortlessly as selling them nearby.”

Source: CEI Manufacturing

Deciding where to produce goods came down solely to cost rather than proximity to consumers. Several Asian countries reaped the benefits from global investment flows and became low-cost manufacturing hubs. In 1970, less than $300 billion worth of merchandise crossed borders. By 1990, the figure had jumped more than ten times to $3.5 trillion.

In 1993 US president Bill Clinton signed the North American Free Trade Agreement (NAFTA) with Mexico and Canada. The World Trade Organization (WTO) was established in 1994, further easing capital controls and reducing trade barriers. As more countries embraced free markets, globalization flourished. By the turn of the century, container shipping was used to transport around 90 percent of the world’s freight.

When China joined the WTO in 2001, it was heralded as a victory for free trade and economic liberalization. Armed with inexpensive labor, China steadily increased exports by assuming the role of the world’s factory. “Made in China” labels were ubiquitous on clothes, toys, furniture and, eventually, electronics. Cheap imports were a windfall for American consumers.

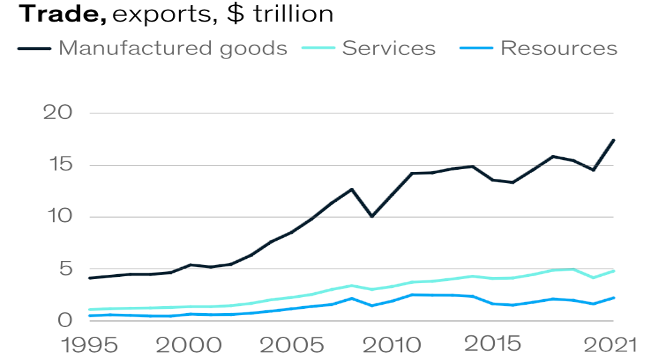

International trade in goods increased from $6 trillion to $15 trillion between 2000 and 2010. Exports of services worldwide almost quadrupled to $4 trillion. The significant decline in telecommunications costs and the proliferation of broadband internet made it possible to cheaply deliver services across long distances. World trade as a share of GDP reached a record high of 61 percent in 2008.

Source: Bank of England

Following the Great Recession, doubts about the future of globalization emerged. The flow of goods leveled off after nearly twenty-plus years of growing at twice the rate of GDP. The slow, jobless recovery saw news stories discussing “globalization” to take a sharply negative swing.

“Globalization has made the financial elites who donate to politicians very wealthy,” said Donald Trump during his 2016 presidential campaign. “But it’s left millions and millions of our workers with nothing but poverty and heartache.” He asserted that the US is getting “killed” by other nations on trade. The Trump administration imposed tariffs over the objection of allies, prompting retaliation and the spread of trade barriers elsewhere.

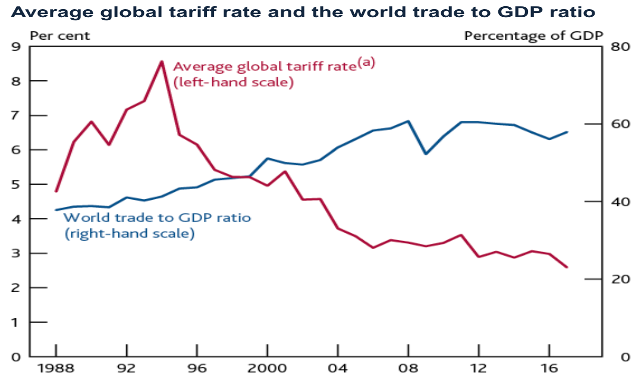

“We are unravelling globalization and losing the battle,” French president Emmanuel Macron said in a speech at Davos in 2018. “We are going back towards protectionism and breaking up what the WTO created.” The average global tariff rate fell from above 8 percent in 1994 to 2 percent in 2017. It was ticking higher again.

The pandemic prompted a new wave of globalization obituaries. Companies and governments were now questioning just-in-time supply chains and seeking to onshore or near-shore more of their operations. “The risk of a debilitating 1930s-style overshoot in deglobalization is massive,” wrote Harvard economist Ken Rogoff, “particularly if the US-China relationship continues to fray.”

Many posit that it is conflicts over power that most threaten globalization. According to BlackRock CEO Larry Fink, “the Russian invasion of Ukraine has put an end to the globalization we have experienced over the last three decades.” German chancellor Olaf Scholz warned that “there is a threat of a new division of the world. Everyone against everyone and everyone for themselves, instead of global responsibility and international solidarity.”

What’s the fate of globalization? Is it really in retreat? At 57 percent of GDP, global trade is still less than it was in 2008.

Source: The Economist

It is crucial to examine the data in the face of such ambiguity. Consider the following: globalization didn’t stop or reverse after 2008. Global trade just grew slower than the rate of economic expansion. Global trade climbed in value from $39 trillion in 2008 to $55 trillion in 2022, a 41 percent rise, while global GDP increased from $64 trillion to $96 trillion, a 50 percent increase. As a result, when measured in terms of GDP, global trade seems to have plateaued.

The volume of world trade is 35 percent higher than in 2010, and it grew across all major regions. Trade in merchandise goods jumped from $15 trillion in 2010 to a record $22 trillion despite disruptions to supply chains. Between 2010 and 2022, trade in services increased twice as fast as trade in goods, growing from $4 trillion to $7 trillion.

According to economist Richard Baldwin, “Digital technology opened the door to trade in intermediate services, and high-income countries have few or no barriers to this sort of export.” At 14 percent of global GDP, trade in services is a relatively recent phenomenon and sits where goods trade was in the 1960s. This is the next frontier.

The world is still deeply interconnected, and recent turbulence has shown trade flows to be remarkably durable. In 2022, trade between the US and China reached a record high of $690 billion. And while it is assumed that Western sanctions have cut Russia’s economy off from Europe, the value of Russian exports to the EU increased last year.

Financial globalization also continues. Total cross-border M&A increased from $685 billion in 2010 to a record $1.7 trillion in 2021. Portfolio equity flows have doubled from $770 billion to $1.4 trillion. The global stock of foreign investment relative to GDP, at roughly 180 percent, has changed little since 2008, but more countries are participating.

Source: McKinsey Global

What about the move to regional supply chains? Most international flows already take place within regions, and short-distance trade has not grown faster than long-distance trade over the past few years.

In the modern global economy, countries exchange not only final products but also intermediate inputs. Every region has been importing 25 percent or more, in value-added terms, of at least one important type of resource or manufactured good that it needs. So there were 355 regional trade agreements (RTAs) in place last year, up from 200 in 2010, and more are expected. Trade barriers keep coming down. Tariffs remain at forty-year lows.

Many companies are rethinking their reliance on China and slowly shifting production to other Asian countries. The real reason is that Chinese labour is no longer cheap. Manufacturing wages have quadrupled over the last decade to an average of $8.27 per hour. The cost of labour is less than $3 in Malaysia, Vietnam, India, and the Philippines. China is pricing itself out of low-cost manufacturing to move up the value chain and boost domestic consumption.

In the 1980s, before it was China’s turn, Japan served as the political punching bag. Nearly two-thirds of Americans called Japanese trade practices unfair. A group of US congressmen smashed Toshiba products on Capitol Hill. Despite president Reagan imposing voluntary restraints on Japanese car exports, Japan’s trade surplus with the US grew from $7 billion in 1980 to $50 billion by 1990.

Trade disputes are quite common. The US and Canada have been quarreling over softwood lumber for decades. France’s agricultural sector is heavily subsidized. Globalization, however, is not in retreat. “Integration into the global economy is a historical trend,” as Xi Jinping stated at Davos in January 2017. “It is the big ocean that you cannot escape from.”

Next time you hear someone citing deglobalization as evidence that we are living in a new inflationary era, just keep quiet and move on. You know the facts.