We continued the tradition of The Most Interesting Dinner in the World in Toronto to start the new year.

As is customary at our events, each attendee was requested to bring a chart to discuss with the group. Please find a summary of the charts and discussion below.

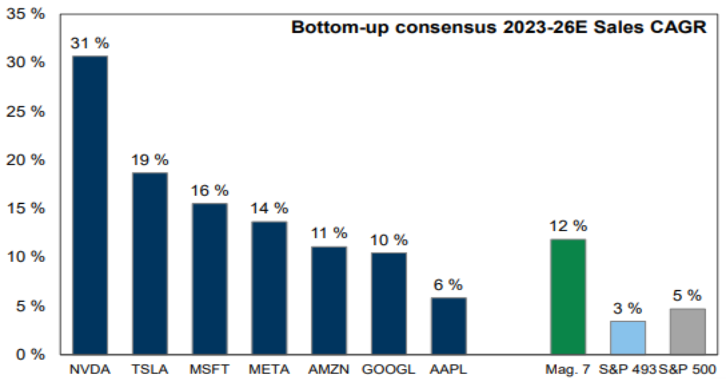

Chart 1: Long Dominatrix The belief that the Magnificent Seven are the most crowded trade on the planet is overwhelming, but the typical investor is underweight those names compared to the index. The pain trade is an acceleration of MAG7 outperformance.

Chart 2: Short Gloom “What if the Roaring Twenties are behind us?”

Chart 3: Short Scrooge There is no viable solution to address unsustainable budgets without encountering a crisis.

Chart 4: Long Conundrum “Real return bonds are essentially free money.”

Chart 5: Long Unknowing Who thought the October 7 attacks would disrupt maritime trade in the Red Sea and result in the US and UK striking Houthi forces in Yemen? What comes next?

Chart 6: Short Gremlins When did you start believing in yourself?

Long Dominatrix

Source: Goldman Sachs

“While the strong runup in the Magnificent Seven (MAG7) stocks left many investors filled with fear and regret, I don’t think these companies are overvalued,” says the speaker.

Since 2020, collectively, Amazon, Alphabet, Microsoft, Meta, Nvidia, and Tesla, have tripled their earnings. The 493 biggest US stocks that aren’t among this cohort have grown their earnings per share by only about 25 percent.

MAG7’s margins expanded by nearly 750 basis points to 23 percent in the fourth quarter and analysts expect another 250 basis points increase during the next three years. In contrast, margins for the 493 S&P 500 companies contracted 110 basis points in the fourth quarter and are expected to rise only 44 basis points by 2026.

In aggregate, the MAG7 currently trade at a forward P/E multiple of 30x compared with 20x for the overall index and 18x for the remaining 493 stocks. While elevated versus the last ten years, the 50 percent P/E premium ranks below the peak 103 percent premium reached in 2021 and 73 percent premium at the height of the dot-com bubble.

“Many are cautious looking at the lofty valuations, however, MAG7’s strong earnings prospects must be taken into consideration,” the speaker adds. The price/earnings-to-growth (PEG) ratio for the S&P500 is 1.88 while the MAG7 is trading at an attractive PEG ratio of 1.11.

“While the belief that the MAG7 have become the most crowded trade on the planet has grown overwhelming, the reality is the typical mutual fund and hedge fund is underweight those names compared to the index weight,” a participant states. “The pain trade entails an acceleration of MAG7 outperformance rather than the catchup trade that most anticipate.”

Short Gloom

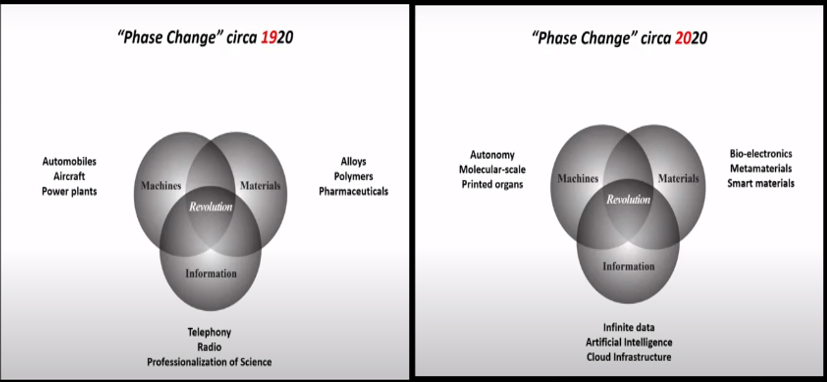

Source: Mark Mills, The Cloud Revolution

The speaker presented a compelling case for optimism, referencing Mark Mills’ 2021 book titled “The Cloud Revolution: How the Convergence of New Technologies Will Unleash the Next Economic Boom and A Roaring 2020s.” The book forecasts an economic boom driven by the convergence of radical advances in three primary

...