The collapse in total factor productivity (TFP) is by far the main cause of the disappointing growth in the US since 2008. In general, TFP captures the efficiency with which labor and capital are combined to generate output. This depends not only on businesses’ ability to innovate, but also on more efficient resource allocation, market dynamism and “creative destruction.”

But what we have seen over the years is strained corporate balance sheets and a dysfunctional banking sector have weakened capital investment and led to slower implementation of technical advances and a misallocation of capital to zombie companies. By actively intervening in the financial system and reducing the real interest rate below its long-term equilibrium value, the Speaker said the Fed has propagated aggregate demand and artificially supported asset prices. “What are the consequences of this?”

Eventually, he continued, the unorthodox easy money policy will suddenly and unexpectedly breakdown. At that moment the stock market crashes, and the economy contracts. Because the capital overhang is much greater, this next period of “liquidation” will be more prolonged and painful than the original recession would have been had the Fed not tried to fight it. No one was sure when this occurs.

A techno-optimist view was that it takes time for radical technological changes in robotics, artificial intelligence, biotechnology, digitization, and materials design to increase productivity. Maybe the US is repeating the “productivity paradox” of the late 1980s, when, as Robert Solow said, “the computer age was visible everywhere but in the productivity statistics.”

It is hard to argue that the Bay Area is a low-productivity state. Perhaps the nation can be divided into low-productivity states and high-productivity ones—which makes the calculated average look ordinary—and the former may eventually converge to the latter? The importance of a productivity rebound cannot be overstated given diminishing slack in the economy.

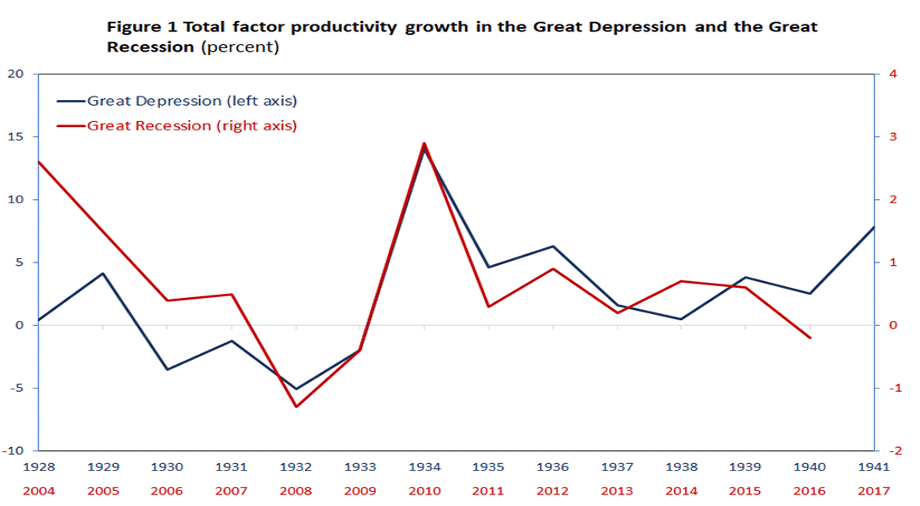

Source: Kendrick (1961), Bureau of Labor Statistics

The chart compares the path of TFP growth in the Great Depression (blue line) and the Great Recession (red line). The parallels in the dynamics of the two series are striking. In both periods, TFP growth slowed before the crisis. TFP grew at an annual rate of 2.9 percent between 1920 and 1925 and slowed to 1.4 percent between 1926 and 1929. This 50 percent decline is comparable to the slowdown in TFP growth from 1.7 percent in 1998–2003 to 0.8 percent in 2004–07. TFP growth was lowest and even negative during the worst phase of both recessions, then strongly recovered from its trough, but declined again for several years.

In contrast to conventional wisdom, the 1930s were arguably one of the most technologically progressive decades in US history, with the discovery of new materials (Plexiglas, Teflon, and nylon) and the electrification and reconfiguration of American factories. Public expenditures on improving the roads infrastructure made the transportation of goods across regions easier. Yet, productivity growth was low in the late 1920s and early 1930s. Aside from the sharp uptick in 1934, it wasn’t until 1939–41 that there was a strong and sustained productivity growth until the US entered World War II. Growth recovered against the backdrop of strong fiscal stimulus (in response to the 1937–38 recession) and still double-digit unemployment rates.

Unlike then, it seems the timing was not right for President Trump’s 2017 Tax Cuts and Jobs Act, as the output gap had already closed, and recession risks were minimal. TFP growth has thus remained weak in 2018 and 2019. Assessing the productivity-enhancing capabilities of recent innovations and their likely speed of diffusion is no easy task. But as the years go by without a productivity rebound in response to technological changes, it could just be that the Speaker is right. We must deal with the overhang from the financial crisis. There is no other way.

Photo: Shuttershock